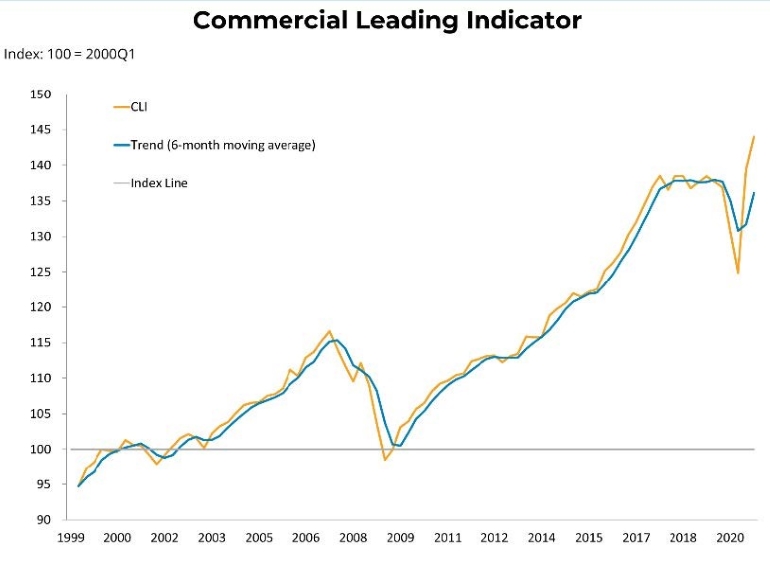

Commercial Indicator Reaches High in Q4 2020

The BCREA Commercial Leading Indicator (CLI) reached a new high since the start of the series in 1999. The CLI rose from 139 to 144 in the fourth quarter of 2020, representing the second consecutive increase after four consecutive quarterly declines. Compared to the same time last year, the index was up by 5 per cent.

Although the CLI is responding to a sharp rebound in economic, financial and employment conditions, there is more here than meets the eye. Growth in these conditions would normally imply an improvement in demand for retail and office space. However, the complexities of the COVID-19 pandemic and related public health restrictions are driving a wedge between what we see in the data and what is being experienced on the ground.

Health restrictions in BC were tightened in the fourth quarter of 2020 to address rising COVID-19 cases. Despite this, manufacturing sales continued to recover, bolstered by strong demand for wood products to supply new home construction in Canada and the US. The increase in wholesale trade was driven by higher sales in motor vehicles and building materials, as many households undertook home renovations in the second half of 2020. Retail sales also continued to grow in the fourth quarter, but at a slower pace than the previous quarter as travel and health restrictions decreased mobility in retail spaces.

Employment growth in key commercial real estate sectors such as finance, insurance, real estate (FIRE) and leasing increased by about 10,400 jobs in the fourth quarter. Combined with employment growth in the previous quarter, this resulted in a full recovery of job losses in the FIRE sectors from the first half of 2020. Manufacturing employment was also up by about 5,700 jobs in the fourth quarter. Employment growth in this sector in the second half of 2020 nearly made up for all losses in the previous four quarters.

The CLI’s financial component was positive in the fourth quarter of 2020, as REIT prices rose and risk spreads fell, and investors gained confidence in the recovery of the global economy following widespread rollouts of the COVID-19 vaccine.

The Largest Number of Homes for Sale

The Largest Number of Homes for Sale